The NRI Guides Team regularly reviews this article to ensure the content is up-to-date and accurate. The last editorial review and update were on 25 October 2023.

When travelling to India, you may be required to complete the Indian Customs Declaration Form. This article explains what information is required on the form, and provides some tips on how to complete it accurately.

By following these simple guidelines, travellers can help make sure that their arrival in India goes as smoothly as possible.

Table of Contents

What is a Customs Declaration Form?

In order to help ensure that the country’s customs process runs smoothly, travellers may be required to fill out a customs declaration form. This form will provide officials with information about the traveller and the items they are bringing into the country.

Is the Customs Declaration Form mandatory for all travellers to India?

Since 2016, the Customs Declaration Form is mandatory only for passengers having prohibited or dutiable goods in their possession or goods in excess of their eligible duty-free allowance.

Earlier it was mandatory for all passengers and known as a disembarkation card.

How to Get the Indian Customs Declaration Form

If you are travelling to an Indian airport from outside India, you can request the cabin crew for a Customs Declaration Form. Most airlines will have copies of the form to distribute if needed. In case you don’t get it from your flight, you can get it at the port of entry before the Immigration Counter.

If you have goods above the duty-free limit, make sure to file the correct declaration of your baggage in the Customs Declaration Form and opt for the Red Channel.

Contents of Indian Customs Declaration Form

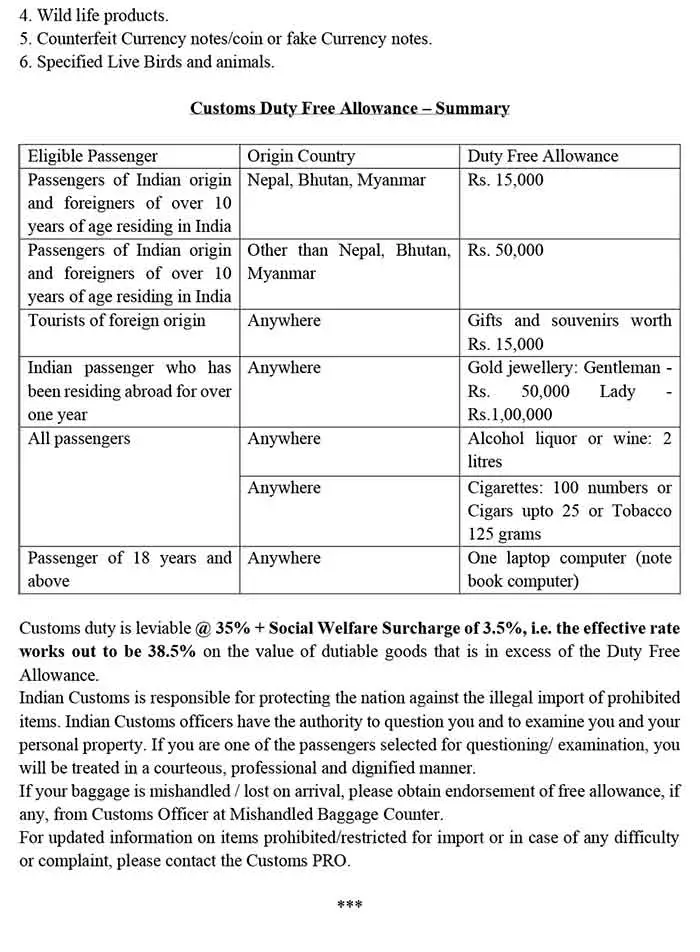

The Customs Declaration Form asks for the following details:

- Name of the Passenger

- Passport Number

- Nationality

- Date of Arrival

- Flight No.

- Number of Baggage (including hand baggage)

- Country from which coming

- Countries visited in the last six days

- The total value of dutiable goods being imported (Rs.)

- Are you bringing the following items into India? (please tick Yes or No)

Prohibited Articles

- Gold jewellery (over Free Allowance)

- Gold Bullion

- Meat and meat products/dairy products/fish/poultry products

- Seeds/plants/seeds/fruits/flowers/other planting material

- Satellite phone

- Indian currency exceeding Rs. 10,000

- Foreign currency notes exceed US$ 5,000 or equivalent

- The aggregate value of foreign exchange including currency exceeds US$ 10,000 or equivalent.

In case the answer to any of the above questions is ‘Yes’, you have to report to the Customs Officer at the Red Channel counter.

You can read our detailed guide on duty-free allowance for travellers to India.

Indian Customs Declaration Form Sample

Here is the updated sample form, extracted from the CBIC Travellers Guide.

You can download a sample of the Indian Customs Declaration Form in PDF here.

Tips for filling up the Customs Declaration Form

Before filling out the form, read the instructions on the form. Make sure you are aware of the prohibited goods and duty-free allowance.

It is important to be as accurate and detailed as possible when filling out the form, as providing false or incomplete information can result in delays or other problems. It is a legal offence not to declare dutiable items.

Visitors are also required to declare if they are carrying any currency in excess of the allowed limits. Here is our guide on currency limits while travelling to India.

What to do with the Customs Declaration Form

While exiting the airport terminal you have to go through the Red Channel. At the exit give the form to the customs official who will stamp the form and return it back to you. If there is any item that you need to pay the duty on, you can pay the duty here.

Additionally, visitors should be aware that they may be asked to open their luggage for inspection at any time. However, if everything is in order, the process of clearing customs should be fairly straightforward.

It is important to keep this form safe, as you may need to show it when exiting the country. For those who lose their form, replacement copies can be obtained from the customs office at the airport.

Customs Declaration Through ATITHI Mobile App

Passengers with dutiable goods can also file a declaration of dutiable items as well as currency even before boarding the flight to India by using the ATITHI mobile app.

READ NEXT: Guide To ATITHI App For Indian Customs Declaration

Frequently Asked Questions

What are the Red and Green Channels in Indian airports?

For the purpose of Customs clearance of arriving passengers, a two-channel system has been adopted: Green Channel is for passengers not having any dutiable goods. Red Channel is for passengers having dutiable goods.

Can I use the Customs Declaration Form for currency declaration?

A declaration of foreign exchange/currency above the prescribed limit is required to be made in the prescribed Currency Declaration Form.

Should crew members fill Customs Declaration Form?

Yes, crew members are also required to submit the correct declaration before customs authorities.

You May Also Like

- Indian Customs Alcohol Allowance and Duty

- Indian Airport Customs Duty for LCD/LED TV

- Indian Customs Gold Duty Allowance and Rules

- Complete Guide To Indian Customs Duty-Free Allowance

- Transfer of Residence to India: Customs Rules for NRI

Copyright © NRIGuides.com – Unauthorized reproduction of this article in any language is prohibited. The information provided on this website is intended for general guidance and informational purposes only. It should not be considered a substitute for professional advice, and travellers are encouraged to verify visa requirements and travel advisories through official government sources before making any travel arrangements.

Source: Central Board of Indirect Taxes and Customs

Aneesh, the Founder & Editor of DG Pixels, holds a Master’s Degree in Communication & Journalism, and has two decades of experience living in the Middle East. Since 2014, he and his team have been sharing helpful content on travel, visa rules, and expatriate affairs.

If you take flowerbulbs into India and you report them to customs, thorugh the red channel, and customs declares them unfit for inmport (plant material); Will there be a fine for the attempt bringing in these goods into India, or will the goods only be confiscated and then the passenger have a free pass to enter India?

Hi,

I am arriving in Delhi on 07/09/2023 from the UK.

I will have the following electronic (used items) in addition to my asus ux425JA note book.

1) samsung galaxy tab A7 lite 1 year old (value £149.00 when new)

2) A Huawei P20 lite mobile phone over 5 years old (value £70.00)-only used in UK

3) An IMO Q2 plus (value £35.00) Only used overseas

4) an Anker power bar slim 10,000MHa (value £20.00)

I also have the following medication:

1) Sertraline 100mg x 28

2) metformin 1000mg x 56

3) Dapagliflozin 10mg x 28

will I need to declare the above or can I go through the green channel?.

I want to bring gold coins / Bars … I have read in travellers guide for NRI gold coins / Bar are allowed limit is 20 grams.NRI who stay in abroad more than six months they have to pay concessional rate of duty 12.5% + 2.5% surcharge will be pay in convertible foreign currency.

Since ATITHI app is not working. We are struggling to file declarations.Request you to advise alternative ways to file online declaration .

Is a online copy that can be downloaded

Hi I have 60000 Indian currency ,can I bring that back from Canada to India, is there a duty for that if so how much pls helo

Very useful information..

Thanks for your kind words Suneel 🙂